Coverage period maximum 90 days

These individual plans are very good coverage for accidents and new medical conditions that begin after the policy effective date

These Plans Do Not Cover Pre-Existing Conditions and are not appropriate for clients with recent or ongoing medical conditions. UnitedHealthcare (UHC) Short Term plans Do Not cover Pregnancy or Preventative Care.

UHC Plans require passing eight (8) underwriting questions listed below.

Rates are 40% – 60% less than ACA Marketplace Plans, both individual and group.

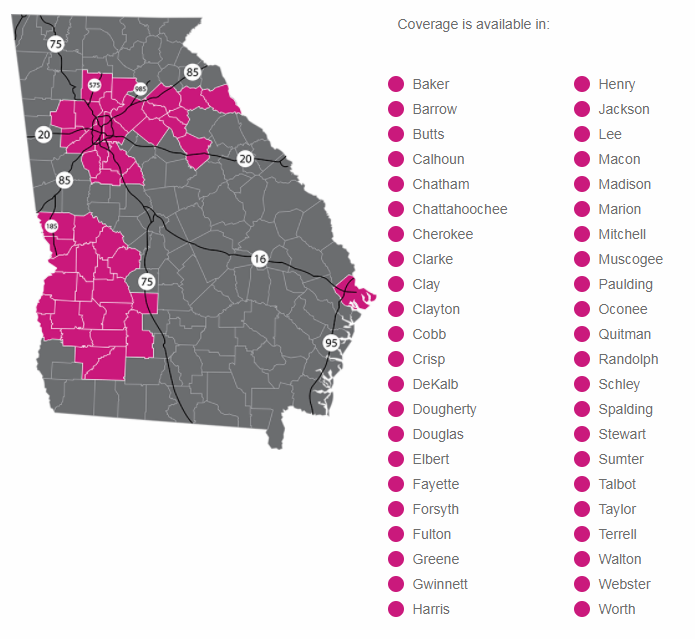

Plans Provide Access to UnitedHealthcare’s Choice + PPO Network in Georgia & Nationally

The Maximum Coverage Period is 90 Days

Is a Covid Test (regardless of the results) taken within the 6 months prior to the person’s New UHC/Golden Rule policy effective date make Covid a Pre-Existing condition and exclude it for coverage?

YES, it is a pre-existing condition and would not be covered, see the paragraph below.

For GA Residents: No benefits are payable for pre-existing condition expenses.

Pre-Existing Condition means any illness, injury or condition for which medical advice, care or treatment was recommended or received within the 6 months immediately prior to the covered person’s effective date; or any illness, injury or condition for which any diagnostic procedure or screening was recommended to or received by a covered person within the 6 months immediately prior to the covered person’s effective date that results in medical care or treatment after the covered person’s effective date; or

any illness, injury, condition or symptom(s) that, in the opinion of a doctor, manifested itself in a manner that would have caused an ordinarily prudent person to seek medical advice, diagnosis, care, treatment or further evaluation within the 6 months immediately prior to the covered person’s effective date.

Note: Even if a person had prior UnitedHealthcare / Golden Rule coverage or policy and the pre-existing condition was covered under that prior plan, it will not be covered under this plan.

UnitedHealthcare / Golden Rule Required Underwriting Questions:

If a person answers YES to any of the following eight (8) questions, coverage will be declined.

General Information

1. During the past 5 years, has any applicant been declined for insurance by a carrier other than Golden Rule Insurance due to health reasons? The person(s) named will not be covered under the policy.

2. Has any applicant lived in the 50 states of the USA or the District of Columbia for less than the past 12 months? The person(s) named will not be covered under the policy.

3. During the past 12 months, has any applicant smoked cigarettes or e-cigarettes or used tobacco in any form (including smokeless tobacco) or nicotine substitute?

Medical History Information

4. Is any applicant currently pregnant, an expectant parent, in the process of adopting a child, or undergoing infertility treatment? If yes, coverage cannot be issued.

5. Within the last 5 years, has any applicant received medical or surgical consultation, advice, or treatment, including medication, for any of the following: blood disorders, liver disorders, kidney disorders, chronic obstructive pulmonary disorder (COPD) or emphysema, diabetes, cancer, multiple sclerosis, heart or circulatory system disorders (excluding high blood pressure), Crohn’s disease or ulcerative colitis, or alcohol or drug abuse or immune system disorders? The person(s) named will not be covered under the policy.

6. During the past 12 months, has any applicant been advised to undergo any test (except for HIV test), treatment, hospitalization, or surgery which has not yet been completed or for which results have not yet been received? The person(s) named will not be covered under the policy.

7. Within the last 5 years, has any applicant received treatment, advice, medication, or surgical consultation for HIV infection from a doctor or other licensed clinical professional, or had a positive test for HIV infection performed by a doctor or other licensed clinical professional? The person(s) named will not be covered under the policy.

Other Coverage Information

8. Does any applicant now have, or is any applicant currently applying for, other hospital or medical expense insurance that will not terminate prior to the requested effective date? (Other hospital or medical expense insurance does not include fixed indemnity insurance.) The person(s) named will not be covered under the policy.